Liechtenstein – A Small, Landlocked Financial Hub In Central Europe

Bordered by Switzerland to the west and Austria to the east, with a population of about not more than 38,000 people and a GDP of about $5 billion, Liechtenstein is a European constitutional monarchy with German as its official language.

The country is a member of the European Economic Area and enjoys access to the single market. The financial sector is a major contributor to the economy, making up about 22% of GDP, and is governed by the Financial Market Authority (FMA). Liechtenstein is well-respected for its stable and reliable financial system, and works with the FATF to combat money laundering and terrorist financing.

Government Takes Steps to Promote Cryptocurrency Industry

The government has taken a number of steps to promote the development of the cryptocurrency industry, including:

Passing legislation that provides a legal framework for the use of cryptocurrencies.

Creating a regulatory sandbox for cryptocurrency businesses.

Investing in research and development of blockchain technology.

Attracting cryptocurrency companies to the country.

As a result of these efforts, Liechtenstein has become a hub for cryptocurrency activity. The country is home to a number of cryptocurrency companies, including Bittrex Global, Bitclear, and Neon Exchange. Liechtenstein is also home to the House of Blockchain, a co-working space and incubator for blockchain startups.

The government of Liechtenstein is committed to creating a favourable environment for the development of the cryptocurrency industry. The country’s crypto-friendly policies have made it a popular destination for cryptocurrency businesses and investors around the world.

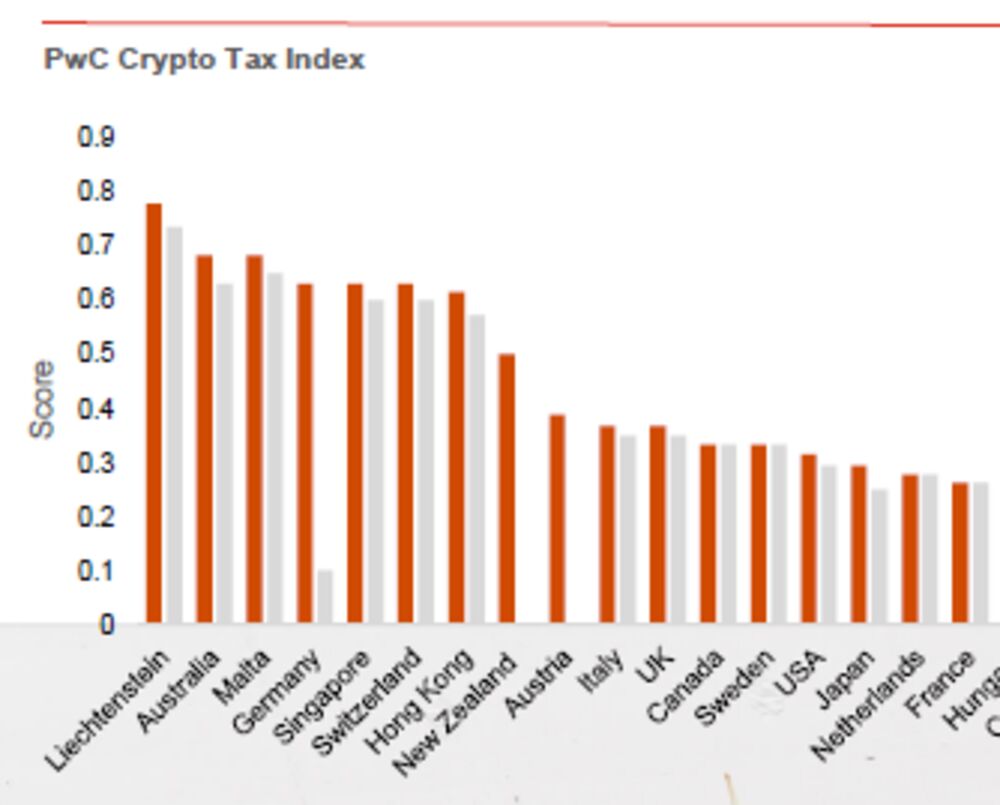

Worlds Top Rated Cryptocurrency Tax Regime

No capital gains tax on cryptocurrency profits: Profits from the sale of cryptocurrency are not subject to capital gains tax in Liechtenstein. This makes Liechtenstein one of the most attractive countries in the world for cryptocurrency investors.

Low corporate tax rate: The corporate tax rate in Liechtenstein is 12.5%. This is lower than the corporate tax rates in many other countries, making Liechtenstein a competitive location for cryptocurrency businesses.

No withholding tax on cryptocurrency payments: There is no withholding tax on cryptocurrency payments in Liechtenstein. This means that cryptocurrency businesses can pay their employees and suppliers in cryptocurrency without having to withhold any tax.

Source: Crypto Tax Policies: Liechtenstein Top Rated Country – Bloomberg

Establishing a Crypto Business in Liechtenstein

Cryptocurrency is regulated in Liechtenstein under the Token and Trusted Technology Service Provider Act (TVTG) which passed in 2019 and provides a comprehensive framework for the regulation of cryptocurrencies and related services.

The TVTG defines a cryptocurrency as “a digital representation of value that is not issued by a central bank or a public authority, is not legal tender, and does not have legal status as a currency or money but is accepted by natural or legal persons as a means of payment and can be transferred, stored or traded electronically.”

The TVTG applies to any person or entity that provides services related to cryptocurrencies, such as:

- Issuing or offering cryptocurrencies for sale

- Providing exchange services for cryptocurrencies

- Providing custodial services for cryptocurrencies

- Providing investment services related to cryptocurrencies

In order to provide services related to cryptocurrencies, a person or entity must be licensed by the FMA, who will consider a number of factors when assessing an application for a license, including:

The applicant’s experience and qualifications

- The applicant’s business plan

- The applicant’s financial resources

- The applicant’s compliance with AML/CFT requirements

The TVTG also imposes a number of requirements on cryptocurrency service providers, including:

- Keeping records of all transactions

- Identifying and verifying the identity of their customers

- Taking steps to prevent money laundering and terrorist financing

A comprehensive and well-designed piece of legislation that provides a clear framework for the regulation of cryptocurrencies in Liechtenstein, the TVTG is designed to protect investors and to ensure that cryptocurrency service providers comply with AML/CFT requirements.

How long does it take to establish a cryptocurrency business?

It can vary depending on a number of factors, including the type of business, the experience of the applicant, and the availability of resources. However, in general, the process will take anywhere from a few weeks to a few months.

The first step in opening a crypto business in Liechtenstein is to register a company with the Commercial Register of Liechtenstein. The applicant must then apply for a license from the Financial Market Authority of Liechtenstein (FMA) which will review the application and generally make a decision within a few months.

If the application is approved, the applicant will be issued a license to operate a crypto business in Liechtenstein.

The license will be valid for a period of one year and can be renewed for additional periods of one year. Once the license is obtained, the applicant can begin operating their crypto business.

In a Nutshell

In a nutshell, the process of opening a crypto business in Liechtenstein can be relatively straightforward. However, it is important to be aware of the requirements and to plan accordingly. By following the steps outlined in this article, you can increase your chances of success in opening a crypto business in Liechtenstein.

Some additional tips for opening a crypto business in Liechtenstein:

Do your research and make sure that you understand the regulations that apply to crypto businesses in Liechtenstein.

Get legal and financial advice from experts who can help you navigate the process.

Be prepared to invest time and resources into opening your business.

Network with other crypto businesses in Liechtenstein and get involved in the local community.