Regulators have intensified their scrutiny of the cryptocurrency industry, imposing fines and penalties to curb risks and ensure compliance, which has noticeably changed the regulatory and legal frameworks governing cryptocurrency over recent years. While regulators strive to bring the crypto domain into the mainstream, there remain pressing challenges to be addressed.

The Initial Coin Offering Era: A Stark Reminder of the Need for Compliance

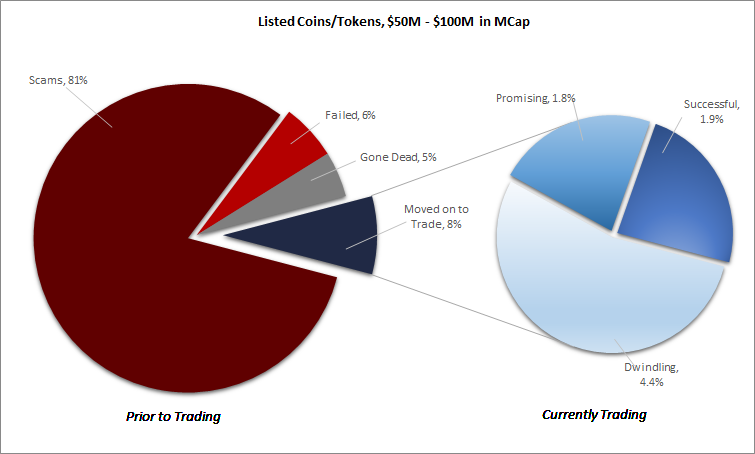

In the years leading up to 2018, there were thousands of ICOs launched, with many raising millions or even billions of dollars. However, most of these ICOs were scams or thinly-veiled securities offerings. As a result, regulators around the world cracked down on ICOs, and many projects were shut down or penalized.

Illustration: ICO Scams, Mar 28, 2018

Source: Bitcoin.com

Also high-profile cases such as those involving Floyd Mayweather Jr., DJ Khaled, Paul Pierce, and Kim Kardashian have made waves in the crypto space, providing a stark reminder of the need for transparency and due diligence.

Crypto fines have since drastically shifted the landscape, representing a rising maturity and stricter regulatory structures in the industry. Heightened enforcement efforts and changes to AML/KYC compliance demands signify a move toward a more compliant environment.

Increased Enforcement Actions and Fines in the U.S. (SEC) and UK (FCA):

- In December 2020, the SEC filed the lawsuit against Ripple Labs, alleging that the company had violated securities laws by selling XRP as an unregistered security. The SEC’s complaint alleged that Ripple Labs raised $1.3 billion by selling XRP to investors in the United States. The SEC argued that XRP is a security because it was sold as an investment contract.

- In June 2023, the SEC filed a lawsuit against Coinbase, alleging that the company had violated securities laws by selling unregistered securities. The SEC is also investigating Binance, the world’s largest cryptocurrency exchange, for possible securities violations.

- The Financial Conduct Authority (FCA), the UK’s financial regulator, has also been increasing its enforcement actions against cryptocurrency companies. In June 2023, the FCA fined Binance £77.7 million for operating without authorization in the UK. The FCA has also warned other cryptocurrency companies that they need to comply with UK regulations or face similar fines.

Key provisions of regulations—such as Anti-Money Laundering/Know Your Customer (AML/KYC), investor protection, and disclosure obligations—are aimed at protecting investors and maintaining market integrity. An individual-focused approach is being applied by the authorities, with fines being imposed to deter bad actors and create a safer investment environment.

Illustration: Crypto fines violations by country

Source: Cointelegraph.com

What to Expect?

The increasing crack-down has thrown the industry in a complex landscape of regulatory scrutiny, with many firms now reticent to venture into the digital asset space, particularly in the US, where companies are less likely to launch new products or services in fear of being fined or shut down by regulators. This is slowing down the growth of the industry and making it more burdensome for investors to access cryptocurrency.

On the other hand, additional transparency could be be attractive, while higher barriers to performing illicit activities could be an invaluable safeguard for the cryptocurrency market and attract investors in regions with more regulatory clarity and transparency, such as Europe and Switzerland.

While some players in the sector may find these circumstances disadvantageous due to the increased compliance costs, we’re seeing others viewing this as an opportunity. Strict laws promote transparency and attract long-term, genuine investments, as well as build trust between institutions and investors.

Ultimately, the lasting effects of the increased enforcement cannot be determined until the future, but the crypto industry appears to be on the way to a more secure and regulated environment.