Shares in regional banks across the US fell sharply, as investors continued to grapple with the implications of the third major bank failure this year. PacWest Bancorp, a California-based bank which has come under scrutiny for its lending to venture capital-backed firms, saw a 20% drop in its shares, exacerbating fears over the banking crisis and financial stability.

The fall was followed by a rescue of First Republic Bank, announced early Monday by regulators who sold deposits to JPMorgan Chase in a deal to resolve the largest US bank failure since the 2008 financial crisis and draw a line under a lingering banking turmoil after concerned customers withdrew more than $100 billion.

“Our government invited us to step up, and we did.”

JPMorgan Chase CEO Jamie Diamond

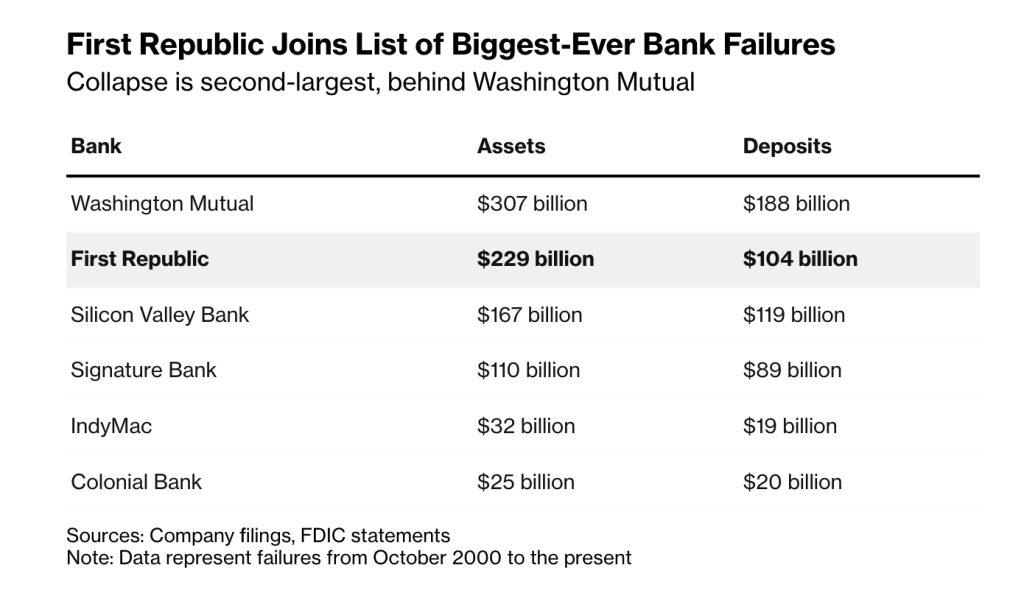

First Republic Bank’s Collapse Becomes Second Largest Bank Failure in US History

First Republic’s collapse now marks the second largest bank failure in US history, following the demise of Silicon Valley Bank and Signature Bank earlier this year. Investors have been badly hit and are now looking for signs of similar risks at other banks.

But the California-based bank was not the only regional lender under pressure. Shares of Western Alliance dropped 15%. The SPDR S&P Regional Banking ETF (KRE) sank 6.3%.

US banks are feeling the pressure as the Federal Reserve continues to raise interest rates. From the near-zero level in March, the benchmark rate has now climbed to over 4.75%.

This week, analysts anticipate a further 0.25% increase, further straining businesses and households as they struggle with debt repayments, which could have widespread implications for the US economy, with reverberations for the banking sector.

US banking analysts have warned that the nation’s banking system – comprising of over 4,000 individual banks – could be facing a wave of consolidation as the economy weakens, comparing the situation to the 1980s, when hundreds of lenders were forced to close following a sharp rise in interest rates and an influx of bad commercial property loans.

Will Bitcoin Disrupt Traditional Finance and Diminish Banks Dominance?

“This part of the crisis is over,” JPMorgan Chase CEO Jamie Diamond said Monday morning. “The system is very, very sound.” But legacy finance isn’t doing any better than the recent crypto failures and for those who take a more globally strategic approach, bitcoin represents a potential route around the centrally-issued digital currencies that are likely to be increasingly prevalent in the future and may restrict what people can do with their own funds.

Despite major recent scandals involving cryptocurrencies, banks and financial institutions remain undeterred in their pursuit of adopting aspects of decentralised finance. In a recent email to Cointelegraph, Sygnum, a Swiss-based digital asset bank, revealed they had seen an influx in inquiries from international crypto firms looking for new banking partners, following the recent collapse of US-based crypto-friendly banks.

So far, Bitcoin survived Silicon Valley Bank and Signature Bank of New York failures, has outperformed the SPDR Gold and the iShares Silver Trust ETFs by a long stretch year-to-date and is up over 69.5%. Gold is up 8.45%. Silver is up 10.5%. Twitter responds with memes.

Note: The author is a cryptocurrency investor.