Amidst growing economic uncertainty, cryptocurrencies are experiencing a revival. Many investors are turning to Bitcoin and other digital currencies as a form of hedge against risk. Switzerland, known for its progressive regulatory stance, may be the biggest winner of this crisis as the crypto sector is set to boom.

In a recent CEO Talk on TeleZuri, Mathias Imbach, CEO of Sygnum Bank, a digital asset-focused financial institution, explains why he is investing in the Metaverse and whether Bitcoin and other digital currencies will continue to recover.

The Swiss financial services industry is anything but dull. The fading of Credit Suisse, which is in the process of being acquired by UBS, has marred the perception of a country that is usually seen as reliable. Nevertheless, this independent nation has had to transform itself before, as seen in its watchmaking industry, and the same may be true for finance.

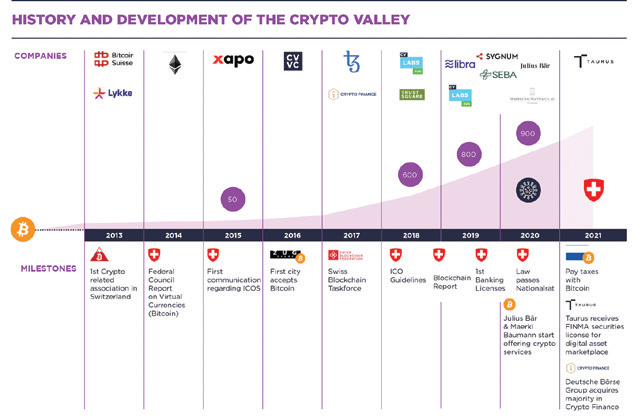

Digital assets are a part of this change. The question is how much of a role can this new innovation play in restoring Switzerland’s competitive edge? In the canton of Zug, the crypto valley is home to many firms that specialize in blockchain, tokenized assets, smart contracts, and cryptocurrencies.

FINMA’s Liberal Stance To Propel Switzerland Ahead Of Other Countries

The Swiss Financial Market Supervisory Authority (FINMA) has taken a relatively liberal stance on the sector, exemplified by its September 2021 authorization of the Crypto Market Index Fund, designed for qualified investors. This stands in contrast to the U.S. Securities and Exchange Commission, which has yet to provide a clear regulatory framework for the cryptocurrency industry. As Switzerland continues to reinvent itself, the digital assets sector could be a key part of its financial revival.

A new report from Swiss blockchain-focused early stage venture capital (VC) investor CV VC has found that digital assets have gone from dismissed hype to an accepted and exciting asset class in 2021. This conclusion was based on the growing demand for such services in the Swiss market.

Source: CV VC, 2021

Despite the market selloff of tech stocks in 2022 and the collapse of the US-based cryptocurrency exchange FTX, firms like Sygnum Bank and Tyr Capital remain committed to providing investors with safe and controlled access to the digital asset market. Just recently, Switzerland’s lawmakers granted the concept of DLT (decentralized ledger technology)-Securities the green light, paving the way for the tokenization of rights, claims, and financial instruments. With this development, the country has opened the door to a new era of tokenized assets and digital securities trading.

Following the U.S. banking meltdown of Signature Bank, Silvergate Capital and Silicon Valley Bank in March, Sygnum Bank has reported an influx of new onboarding inquiries from investors, asset managers and blockchain projects seeking to diversify their crypto investments.

Sygnum Remains Committed To Its ‘Policy Of Not Onboarding Clients From The U.S.’, Focusing Instead On Core Target Markets

However, in response to the sudden demand, the firm has increased efforts to scale its client service support and compliance teams, in order to properly and promptly welcome its new clients.

Dominic Castley, chief marketing officer at Sygnum, apparently told Cointelegraph in a recent email interview:

“Over the past weeks, as the current banking industry events have unfolded, we have seen a significant increase in onboarding inquiries from various international locations, including a number from the UAE and the Middle East.”

Source: Cointelegraph

In April 2023, the digital asset bank further announced a partnership with PostFinance, the fifth largest retail bank in the country, owned by the government, to provide its 2.5 million customers the ability to buy, store, and trade cryptocurrencies.

“Sygnum is a fully regulated and supervised by the Swiss Financial Market Supervisory Authority (FINMA). As such, they are subject to the highest banking standards (e.g. Basel III), meaning that Sygnum must adhere to current risk diversification rules, applying credit risk and overall exposure mitigation techniques for their credit and lending capabilities (i.e. Lombard loans). Upholding these requirements allows Sygnum says it continue its operations in a stable manner, whilst reassuring clients that they can endure market extremities with peace of mind and trust.