Last month, members of the European Parliament (MEPs) voted in favour of three major pieces of legislation that will drastically strengthen the EU’s anti-money laundering (AML) and counter-financing of terrorism (CFT) measures.

According to a press release from 28. March, this initiative is an important step towards curbing the estimated €2.3 trillion in money laundering activities that take place across Europe annually. With the new proposal, the EU seeks to tighten regulations and strengthen enforcement of existing rules in order to better protect its citizens and financial institutions from the threat of money laundering.

- the EU “single rulebook” – regulation – with provisions on conducting due diligence on customers, transparency of beneficial owners and the use of anonymous instruments, such as crypto-assets, and new entities, such as crowdfunding platforms. It also includes provisions on so-called “golden” passports and visas. The text was adopted with 99 votes to 8 and 6 abstentions.

- The 6th Anti-Money Laundering – directive – containing national provisions on supervision and Financial Intelligence Units, as well as on access for competent authorities to necessary and reliable information, e.g. beneficial ownership registers and assets stored in free zones. The text was adopted with 107 votes to 5 and 0 abstentions.

- The regulation establishing the European Anti-Money Laundering Authority (AMLA) with supervisory and investigative powers to ensure compliance with AML/CFT requirements. The text was adopted with 102 votes to 11 and 2 abstentions.

Source: Press Release European Parliament, 28.03.2023

The new regulations, which will be voted on during the upcoming plenary session in April, will require banks, asset managers, and crypto asset managers to conduct more rigorous due diligence when dealing with anonymised financial instruments, such as crypto assets.

They must verify the identity of their customers, the assets they own, and who controls the company. Furthermore, these entities must create detailed AML/CFT supervision plans based on the risk in their sector of activity and report information to a centralized beneficial owners’ register. The implementation of these new regulations is expected to have a significant impact on the EU’s ability to combat money laundering and terrorist financing, as well as the evasion of sanctions.

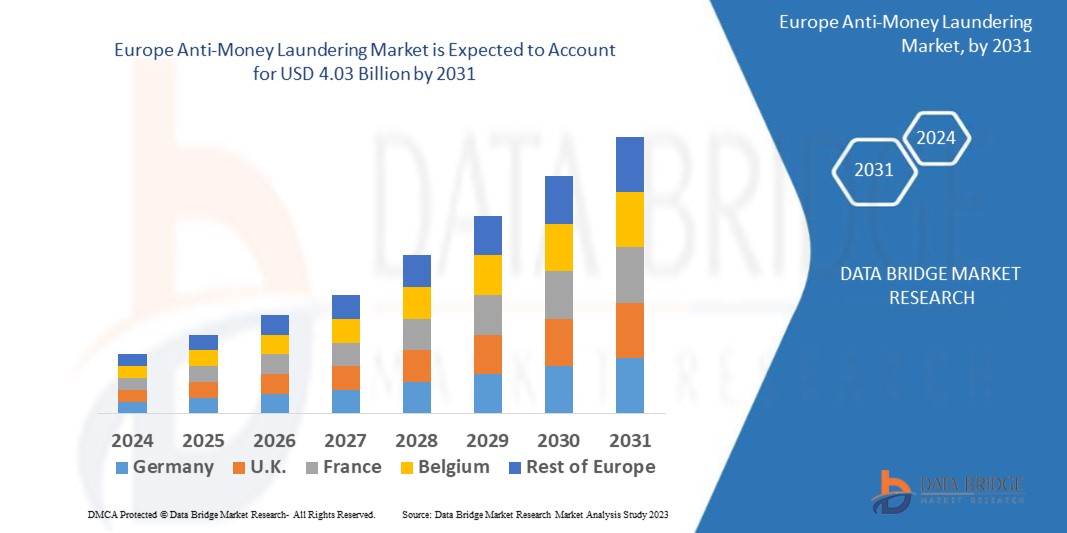

Source: Data Bridge Market Research

New Regulations Aim to Enhance Security of Crypto Asset Transfers

Crypto asset transfers are set to get an overhaul, with new measures in place to ensure the safety of users and combat the risk of money laundering and terrorism financing. Providers like crypto exchanges will now have to verify the source of the asset and identify individual transfers, as per the Markets in Crypto-Asset Regulations (MiCAR).

Under the new rules, information regarding the source and beneficiary of the asset will have to be included in every transfer, just like with traditional money transfers. Person-to-person transfers and exchanges acting on behalf of providers will be exempt from the regulations, as technological solutions are being sought to ensure that each asset transfer can be identified. These changes are necessary to protect users and ensure that crypto asset transfers are compliant with anti-money laundering regulations. The crypto asset industry is growing rapidly, with the total market capitalization of crypto assets having risen from $210 billion to $1.3 trillion in just one year. It is therefore essential that the necessary steps are taken to ensure the safety and security of users.

MEPs Implement Cash and Crypto Payment Limits

Banks, asset managers, real estate agents, and professional football clubs are now required to verify the identity, ownership, and control of their customers to prevent money laundering and terrorist financing. MEPs have suggested a cash payment limit of up to €7000 and a crypto-asset transfer limit of up to €1000, where the customer cannot be identified.

This is to help restrict transactions in cash and crypto assets and help protect the integrity of the financial system. Money laundering and terrorist financing threats are constantly changing, so these institutions must be vigilant in monitoring and mitigating the risks. They must also provide detailed information on the types of money laundering and terrorist financing risks in their sector to a central register. This register is used to track and detect any suspicious activity that could undermine the financial system.

The measures being taken to combat money laundering and terrorist financing can help create a more secure financial system and improve the public’s confidence in it. As the global economy continues to evolve, it is important to stay ahead of the risks associated with these activities and ensure that the integrity of the financial system remains intact.

New Crypto Register and Lower Thresholds to Curb Financial Crimes

MEPs have removed minimum thresholds and exemptions for low-value transfers, and are considering setting up a public register of crypto firms with a high risk of money laundering, terrorist financing, and other criminal activities. This register would help prevent criminals from exploiting the confidentiality rules that come with cryptocurrency, allowing for secrecy and anonymity. This move is part of a larger effort to combat financial crimes, with tracking of cryptocurrency transactions becoming increasingly important in order to prevent illicit activity.

EU Passport & Golden Visa Schemes to Face Stricter Controls & Bans on Cash & Crypto Transactions

MEPs have proposed a strict set of rules to curb the use of cash and crypto assets in transactions. With the potential for misuse by criminals, any EU citizenship obtained through investment – commonly referred to as “golden passports” – are to be banned entirely, while residence investment schemes (“golden visas”) must be subject to strong Anti-Money Laundering (AML) controls. To further protect against fraud, payments in excess of €7000 in cash and €1000 in crypto-assets must be identified and verified.

EU Takes Major Step Towards Cracking Down On Money Laundering and Terrorist Financing

As the European Union takes a stand against money laundering and terrorist financing, the European Parliament has adopted stricter rules to ensure these crimes are properly addressed. In a major step towards closing existing gaps in the EU’s anti-money laundering framework, the new European Anti-Money Laundering Authority (AMLA) will monitor and supervise credit and financial institutions across the EU, classifying them according to risk level.

Initially, AMLA will monitor 40 entities with the highest residual risk profile and present in at least two member states. To fulfil its duties, AMLA will be able to issue mandates and information requests, conduct on-site visits with judicial authorization, and impose sanctions of up to €2 million or 10 percent of an entity’s total annual turnover in the preceding business year for serious violations. MEPs have also suggested extending the agency’s competence to drawing up lists of high-risk non-EU countries.

An additional measure will be the new rules on crypto asset transfers, which will require individual identification of these transfers. This move will close the loophole that allowed for anonymity, helping to prevent money laundering and terrorist financing. By introducing these measures, the EU is taking proactive steps to combat money laundering and terrorist financing, making it clear that these crimes will not be tolerated. With this, the EU is striving towards a more secure and transparent financial system.

Key Take

The EU’s commitment to combatting financial crime is clear, and these new regulations are designed to protect citizens and businesses alike. With the rise in popularity of cryptocurrencies and the associated risks, it is essential that these measures are put in place to ensure that transactions are safe and secure. With these limits in place, the EU can rest assured that it is taking steps to prevent money laundering and other illicit activities.