Financial markets are undergoing a period of rapid transformation as the digital asset revolution takes centre stage. In response, firms must innovate in order to create new value propositions for their clients and partners. These trends could lead to the development and delivery of new products across different asset classes and business models that are accelerating change.

Tokenisation to Revolutionise Legacy Finance Infrastructure

Tokenisation, a disruptive technology, which enables a whole host of capabilities, is among the first steps in this journey to a new horizon for the asset servicing industry. Shaking up the status quo and driving a shift towards more collaborative solutions, it is up to asset service providers to grapple with the challenges posed by this fast-evolving digital world.

To remain competitive, firms must look beyond conventional methods of operation while embracing the power of digital ecosystems, carefully balancing security, performance, and innovation to remain effective and efficient. As the digital grid continues to expand, reimagining how we live and work is no longer an option – it’s a requirement.

Of course, blockchain technology or the Metaverse, unlike for example automobiles, are back-end infrastructure technologies that don’t have a visible consumer interface, making it more difficult to identify its potential for innovation.

But it opens the doors to new product structures with smart contracts governing asset classes in many variations. Tokenisation provides the potential for balancing of liquidity, accessibility, low transaction costs and transparency.

Citibank Bets Big on Tokenisation

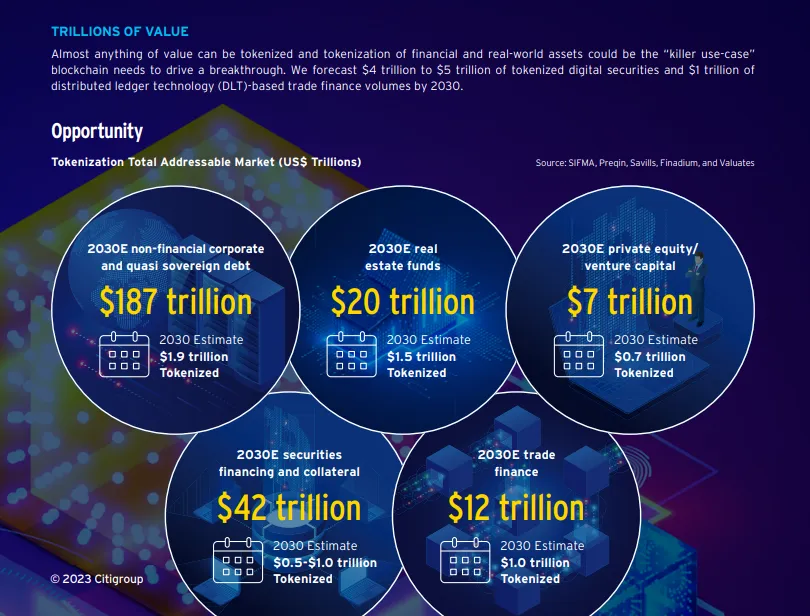

Also Citi, a leading global investment bank, is betting that tokenisation of real-world assets on the blockchain is set to become the next major use case in crypto. The firm believes that the industry is set to grow to between $4 trillion and $5 trillion by 2030, representing an 80-fold increase from current levels.

Blockchain-based tokenization total addressable market by asset class. Source: Citi

Citi’s March report “Money, Tokens and Games”, predicts that digital securities will make up the majority of the tokenized assets (up to $5 trillion), with $1.9 trillion coming from debt, $1.5 trillion from real estate, $0.7 trillion from private equity and venture capital and between $0.5-1 trillion from securities.

Tokenisation of these assets to create digital tokens on the blockchain that represent a share of a real-world asset will surpass legacy financial infrastructure due to its superior technological capabilities, transparency and fractionalization properties, making traditionally illiquid assets, such as real estate and infrastructure, more accessible and tradable.

“Traditional financial assets are not broken, but sub-optimal as they are limited by traditional systems and processes,” it said. “Certain financial assets — such as fixed income, private equity, and other alternatives — have been relatively constrained while other markets — such as public equities — are more efficient.”

Citi argues that blockchain tokenization negates the need for expensive reconciliation, prevents settlement failures and makes tedious operations ever more efficient:

“What DLT and tokenization offer is an entirely new tech stack that lets all stakeholders do all activities on the same shared infrastructure as one golden source of data — no more expensive reconciliation, settlement failures, waiting for the faxed documents or ‘originals to follow’ by post, or investment choices being restricted by operational difficulty in access.”

Despite all optimism surrounding tokenisation, the investment bank recognises growing pains that come with its implementation. There is still a lack of legal and regulatory framework, and many industry players remain sceptical of its success, citing the failed $165 million ASX project. However, Citi believes that in time, the technology will establish a digital, globally accessible asset infrastructure, with smart contract and DLT-enabled automation capabilities that are more efficient than traditional systems.

Governments Grappling with Evolving Digital Asset Space while Scepticism Persists

As different countries navigate the complex regulatory landscape, governments are beginning to grapple with the rapidly evolving digital asset space, introducing regulations to provide a solid foundation for its growth. Like any new frontier, the digital asset market is a wild west, and regulators are faced with a plenitude of challenges.

The European Union and Switzerland are taking the lead in the cryptocurrency revolution with a progressive approach to regulation. Rather than shunning digital assets, EU and Swiss authorities have chosen to embrace them, creating a legal framework providing clarity with assurance to investors.

China is taking a more critical view, Hong Kong creating a licensing regime for virtual asset service providers and Singapore preparing legislation requiring all VASPs to be licensed.

The FATF has also released updated guidance to help governments respond to virtual assets. As regulators become more aware of the potential of digital assets, they are gradually reducing uncertainties surrounding them, paving the way for broader acceptance and use.

And in the U.S., crypto firms are currently navigating choppy waters, as increased government scrutiny and enforcement actions have led to a climate of uncertainty, forcing companies to look for more hospitable waters in other jurisdictions.

Tokenisation: The process of issuing a token that represents an asset. A token acts as a digital certificate of authenticity, enabled by DLT. Tokens essentially exist as strings of code on the blockchain.