Switzerland is Known for Taking a Different Approach than Other Countries

In contrast to the US, Switzerland has taken a unique and progressive stance when it comes to cryptocurrency. Rather than attempting to ban digital assets, Swiss authorities have instead chosen to regulate them. This has allowed the country to remain at the forefront of the digital asset revolution, positioning itself to be a leader in the industry. Switzerland has also established a legal framework that provides clarity and assurance to cryptocurrency investors, allowing them to feel secure in their investments. Furthermore, Switzerland is becoming a hub for cryptocurrency-related businesses, with many exchanges and companies choosing to set up shop in the country. By taking a different approach to cryptocurrency than other countries, Switzerland has become a haven for digital assets, allowing the industry to flourish and grow.

The year 2021 marked a major turning point for the Swiss market with regards to the acceptance of cryptocurrencies and digital assets. Investors jumped into the space at an unprecedented rate and the demand for such services among clients was too strong to ignore. Financial institutions have also started to incorporate digital assets into their portfolios and it’s said that some of the larger banks have started to develop their own digital asset offerings.

According to a new report by Swiss blockchain-focused early stage venture capital (VC) investor CV VC, in 2021 digital assets were no longer subject to dismissal as a mere hype. Instead, they were accepted as a nascent and exciting asset class that is here to stay. This conclusion was based on the growing demand for such services in the Swiss market.

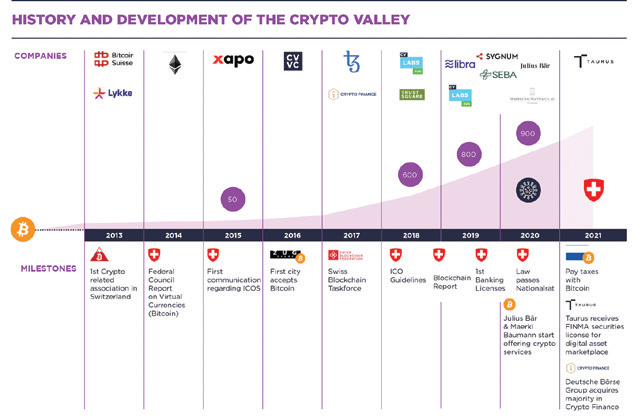

Source: CV VC, 2021

Digital Assets have Become an Integral Part of the Financial World in Switzerland

In April 2023, PostFinance, the fifth largest retail bank and leading financial institution in Switzerland, owned by the government, will provide its 2.5 million customers the ability to buy, store, and trade the most popular cryptocurrencies such as Bitcoin (BTC) and Ether (ETH), with other digital tokens to be added soon.

Partly due to the outflows of funds into digital assets class, PostFinance has taken the decision to partner with Sygnum Bank, a digital financial institution with a Swiss banking license acquired four years ago, servicing Cantonal and private banks.

This was affirmed by Fritz Jost, chief B2B officer of Sygnum Bank, who believes that this move is set to open up a new avenue of opportunity for customers of the Swiss financial services giant.

After conducting an analysis of its customers’ investment needs, PostFinance discovered a strong demand for digital investment services. By using Sygnum’s B2B banking platform, PostFinance will be able to integrate the new offering into its existing infrastructure right away.

With its Swiss banking license, Sygnum provides a secure bridge between conventional finance and digital assets. Its B2B banking platform grants PostFinance the ability to offer its customers flexible and efficient access to a wide range of cryptocurrencies, as well as introducing new revenue-generating services over time, such as staking.

“Digital assets have become an integral part of the financial world, and our customers want access to this market at PostFinance, their trusted principal bank,” said PostFinance Chief Investment Officer Philipp Merkt in a statement. “A reputable and established partner like Sygnum Bank with an excellent service offering is more important than ever.”

“PostFinance became aware of a considerable number in the hundreds of millions each year of outflows to crypto exchanges and the like,” said Jost in an interview with CoinDesk. “So they saw that this is not only as an opportunity to add a new revenue stream, but also realized that this has a lot to do with client retention.”

Jost revealed that PostFinance is considering offering a variety of cryptocurrencies, but that a decision has yet to be made. He added, “We’ve seen banks make crypto available to their customers in the past, and now they want more services such as staking. I can confirm that PostFinance has a plan in place, beginning with the basics of buying, holding, and selling to ease the process for the company and its customers.”

Key Facts

Established in 1906, PostFinance is the banking arm of Swiss Post and is wholly owned by the Swiss government. In 2013, FINMA (Financial Markets Supervisory Authority) granted the company a banking license, thus allowing PostFinance to provide a wide range of banking services, such as retail banking, asset management, and payment services. With their mission to provide reliable and secure financial services, PostFinance has become one of the most trusted banking institutions in Switzerland.

www.postfinance.ch/en/private.html

Sygnum Bank is the world’s first digital asset bank, offering professional and institutional investors, corporates, banks, and other financial institutions a secure and trusted platform to invest in the digital asset economy. In 2019, the company received its Swiss banking and securities dealer license from the Swiss Financial Market Supervisory Authority (FINMA) and was later granted a license for asset management by the Monetary Authority of Singapore. With a commitment to providing the highest level of safety, transparency, and compliance standards, Sygnum Bank is committed to making digital asset banking accessible to everyone.

In July 2022, PostFinance announced plans to broaden its cryptocurrency exposure, as reported by Swissinfo, a local media outlet. Then, in November 2021, Swiss Post, its parent company of PostFinance, issued its initial crypto stamp, also known as a non-fungible token (NFT). In 2017, Swissquote, PostFinance’s competitor, pioneered cryptocurrency trading services for retail customers.

In April 2023, PostFinance announced its partnership with Sygnum Bank to offer regulated digital asset banking services to customers via Sygnum’s B2B banking platform.

As the cryptocurrency market continues to gain traction in countries like Switzerland, Portugal, South Korea and Hong Kong, the United States is increasingly taking enforcement action. Crypto firms operating in the U.S. are facing an increasingly hostile regulatory environment and are having to deal with growing uncertainty. Enforcement actions against these firms are being taken by the government, which has led to a climate of apprehension and unease driving some of these firm to seek out opportunities elsewhere.