The COVID-19 pandemic has created a difficult post-crisis trade landscape, with emerging market volatility arising from the Russia/Ukraine conflict and inflationary central bank policies further exacerbating the situation.

According to the WEF chief executives now identify supply chain turmoil as the greatest threat to their companies’ growth and their countries’ economies, organizations need to reimagine and manage their supply chain differently to ensure business continuity and growth for the future.

Much Needed Solutions for Global Trade Systems

Fintech innovations, such as payments and digital identity, hand-in-hand with blockchain technology have the potential to revolutionise the global trade and supply chain management systems. Coupled with advances in AI and 5G technology, these developments can offer a much-needed solution to the current state of affairs.

These technologies will enable businesses to manage products and services more effectively across international borders, streamline operations, and increase efficiency. Such technologies can allow businesses to better track and monitor shipments, access real-time data on markets and customers, and use predictive analytics to anticipate market trends.

Furthermore, help reduce costs and increase profitability, while also wear down environmental impacts. Ultimately, the use of adaptive technologies will lead to a more integrated, efficient, and sustainable global economy.

Banks Focus on Increasing Efficiency, Reducing Settlement Times, and Digitising the Supply Chain Journey

Faisal Ameen, Bank of America’s head of global transaction services for Asia Pacific, and Japan, recently confirmed that big banks, especially his, are focused on client needs, increasing efficiency, and reducing settlement times. In his mind, this means digitising the supply chain journey. Doing so includes pursuit of financial integration to deliver a single customer platform enabling financing, invoicing, and payments.

As global trade and supply chains attempt to tackle an onslaught of challenges, streamlining processes and solving systemic problems has never been more important. Fintech advancements in blockchain, payments, and finance are all poised to offer a much needed helping hand. Such technologies, combined with innovations in 5G, have the power to revolutionise the way we conduct global trade and manage our supply chains.

To many, blockchain is an enigma – simply a by-product of the cryptocurrency revolution. However, to those in the know, blockchain offers a decentralised ledger that can securely record and verify transactions. In this way, blockchain can fuel a transparent and tamper-proof framework for tracking goods, payments, and services across the entirety of the supply chain.

Imagine a trade environment where every step of the transaction is tracked and recorded in real-time. From the manufacturing process to the point of sale, all activities would be traceable and verifiable. The transparency that blockchain technology provides could drastically reduce the prevalence of counterfeits, fraud, and ensure more immediate access to data.

Cross-Border Payments and Remittances: Streamlining International Trade and Investment

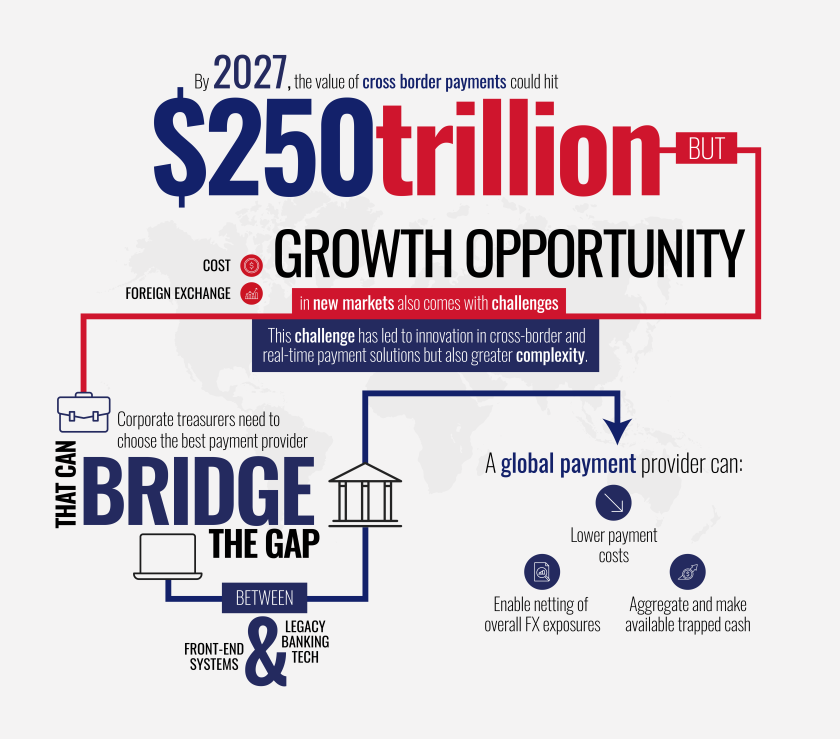

With a value anticipated to hit $250 trillion by 2027, cross-border payments and remittances are increasingly becoming a vital part of the global economy but can be a challenging process for all parties involved. Traditional methods, such as bank transfers, can take days to complete and come with high fees and volatile foreign exchange rates. Cross-border payments and remittances are increasingly becoming a vital part of the global economy but can be a challenging process for all parties involved. Traditional methods, such as bank transfers, can take days to complete and come with high fees and volatile foreign exchange rates.

Illustration by Bank of America

Fortunately, the Fintech industry has introduced real-time settlement systems, currency exchange platforms, and remittance networks that can complete even the most complex transactions in a fraction of the time and with Blockchain technology on the rise, will significantly improve money transfers between countries, facilitating international trade, easy customs and border clearance procedures.

Blockchain technology has made great strides in improving the speed and security of payments, while digital payment and identity technologies are also making a substantial impact. The capacity to exchange payments securely and quickly is essential to the success of trade between parties, leading to trust through greater transparency, security, verifiability while paperless processing would bring many advantages, such as improved accuracy and more efficient processing.

Traditional methods, like wire transfers, are often slow, costly, and prone to errors; conversely, fintech solutions make payments fast, cost-effective, and accurate. In the current geopolitical climate, trust and speed are key to ensure that communication and supply lines remain open. By taking advantage of different technologies, fintech is able to make transactions quicker, more secure, and more economical.

Trade finance is complex, with a variety of methods like letters of credit, bank guarantees, and insurance. Invoice financing is outdated and in need of modernisation. Fintech could bring immense benefits, such as improved efficiency, analytics capabilities, and alternative methods of qualification. Credit scores, Paydex scores, and credit history would not be the only option. Furthermore, fintech solutions could be integrated into existing platforms, making outdated requirements like letters of credit faster or even obsolete.

The Future of Global Trade: A Robust Peer-to-Peer Marketplace

An exciting new way to finance global trade is by creating a robust peer-to-peer (P2P) lending network. This would give small businesses more options than traditional banks and financial institutions and provide access to funding that is more inclusive and competitive. This fintech-enabled marketplace would make it easier to access liquidity and reduce the amount of bureaucracy involved. It would also eliminate barriers and make it easier for everyone to participate.

Key Take

Fintech innovations, Blockchain, and other cutting-edge technologies could revolutionize global trade and supply chains with the potential to increase system security, efficiency, and provide cost savings while enabling cross-border mobility.

These new technologies could have a far-reaching impact on global trade and unlock new pathways for economic growth and social inclusion.