I. Current Legal Framework / US-Regulation on Proof-of-Stake

The current legal framework in the United States concerning proof-of-stake is based on assessment of existing laws. Several provisions have been established to regulate this type of technology. These include the Securities Act of 1933, the Securities Exchange Act of 1934, the Investment Advisers Act of 1940, and the Investment Company Act of 1940. Other relevant provisions are the Bank Secrecy Act of 1970 and the USA PATRIOT Act of 2001. Additionally, guidance from the SEC on cryptocurrency transactions and Initial Coin Offerings provides further clarification on the legal requirements for proof-of-stake.

1. The Howey Test – Criteria for Classifying as Securities

The Howey Test, named after the Supreme Court case SEC v. W.J. Howey Co. of 1946, is used by the Security and Exchange Commission (SEC) to determine if an asset is a security or not. This test consists of four criteria: (1) investment of money (2) in a common enterprise (3) with a reasonable expectation of profits (4) obtained through the efforts of someone else. If an asset is classified as a security, the company must adhere to regulations, provide strict investor protection, and disclose the necessary information. [1]

2. Internal Revenue Service: Digital Assets are a property

The Internal Revenue Service (IRS) has clarified that digital assets, such as cryptocurrencies, are to be treated as property. As such, all general tax principles that apply to transactions involving property must be applied to transactions involving digital assets. It is the responsibility of the taxpayer to include any digital asset activity in their tax return. [2]

3. The Commodity Exchange Act: Cryptocurrencies are Commodities

The Commodity Exchange Act regulates the trading of commodity futures and provides federal oversight of all commodities and futures trading activities in the US. This Act now includes cryptocurrencies, which are defined as commodities, and all futures and commodity options must be traded on organized exchanges. [3]

4. The Digital Commodity Consumer Protection Act (proposed law) is designed to protect consumers by requiring digital commodity platforms to adhere to certain standards. Platforms must prohibit abusive trading practices, disclose or eliminate any conflicts of interest, maintain sufficient financial resources, have strong cybersecurity programs, safeguard customer assets, and report any suspicious transactions. [4]

5. AML: Due diligence and auditing obligations based on laws for the prevention and sanctioning of money laundering

Financial institutions in the United States are subject to laws and regulations that require them to conduct due diligence and auditing to prevent and sanction money laundering. The Bank Secrecy Act (BSA) requires financial establishments to keep records of cash transactions involving negotiable instruments, file reports if the cumulative total of daily transactions exceeds $10,000, and report any suspicious activity that could indicate money laundering, tax evasion, or other unlawful activities in a suspicious activity report. [5]

The Money Laundering Control Act, a United States Act of Congress, also makes money laundering a federal crime. Under this Act, an individual must have the intention to conceal the source, ownership, or control of funds in order for a transaction to be considered a violation of the law. The definition of a “financial transaction” is broad and does not require the involvement of a financial institution or business. It can be as simple as passing money between two people, as long as the intent is to conceal the source, ownership, location, or control of the funds. [6]

6. The Digital Asset Anti-Money Laundering Act (draft) from 2022/12/15

The Digital Asset Anti-Money Laundering Act, drafted as of 2022/12/15, seeks to align the digital asset environment with the anti-money laundering and countering the financing of terrorism (AML/CFT) protocols that oversee the whole financial system.

Extended responsibilities including KYC

The act extends responsibilities, specifically KYC (Know-Your-Customer) requirements, to digital asset wallet providers, miners, validators, and other network participants that may validate, secure, or facilitate digital asset transactions. In order to do this, it requires the Financial Crimes Enforcement Network (FinCEN) to designate these actors as money service businesses.

Add KYC to unhosted (non-custodial) wallets as a prerequisite for a transaction

The Digital Asset Anti-Money Laundering Act proposes that Know Your Customer (KYC) protocols be implemented as a prerequisite for digital asset transactions involving unhosted (non-custodial) wallets or those hosted in non-BSA (Bank Secrecy Act) compliant jurisdictions. This would require banks and money service businesses to verify customer and counterparty identities, keep records, and file reports related to these types of transactions. [7]

7. US Federal Regulation: Requirements for Certain Transactions Involving Convertible Virtual Currency or Digital Assets (draft)

The Financial Crimes Enforcement Network (FinCEN) proposed a rule in December 2020, requiring banks and money service businesses to submit reports, keep records, and verify the identity of customers in relation to transactions involving convertible virtual currency or digital assets with legal tender status, digital assets held in unhosted (non-custodial) wallets, or digital assets held in wallets hosted in jurisdictions identified by FinCEN. [8]

8. Infrastructure Investment and Jobs Act Reporting Requirements

The Infrastructure Investment and Jobs Act has expanded reporting requirements for transactions of over $10,000 to include digital assets. This has the potential to revolutionize how businesses manage and report crypto transactions to the Internal Revenue Service. The Act signified that more regulation is coming to the crypto industry, though it is still quite vague and does not offer specific details. What this means is that 1099 reporting will be applicable to digital assets, and the Securities and Exchange Commission and IRS may soon issue more comprehensive regulations in the future. [9]

9. Counter Terrorist Financing and the USA PATRIOT Act

The USA PATRIOT Act has amended the Bank Secrecy Act with Section 312, which requires U.S. financial institutions to practice due diligence and enhanced due diligence when maintaining correspondent accounts for foreign financial institutions or private banking accounts for non-U.S. persons. This is to help counter terrorist financing. [10]

10. Stablecoin Transparency of Reserves and Uniform Safe Transactions Act of 2022”, S.3970 — Stablecoin Transparency Act

The Stablecoin Transparency and Uniform Safe Transactions Act of 2022 (S.3970) establishes new regulations for entities authorized to issue payment stablecoins. These include depository institutions, entities with a new federal license specifically for payment stablecoin issuers, state-based money transmitting businesses, non-depository trust companies, and other entities authorized by state banking supervisors, as well as national trust banks. Payment stablecoin issuers with the new federal license and similar business models will be eligible to receive Federal Reserve master accounts and services. The Act also establishes new standardized disclosure requirements, such as what assets back the payment stablecoin and the issuer’s redemption policies, and requires attestations from registered public accounting firms. Moreover, all issuers must fully back their payment stablecoins with high-quality liquid assets. The Office of the Comptroller of the Currency (OCC) is introducing a new federal license for payment stablecoin issuers, allowing them to operate nationally. The Stablecoin Transparency Act also makes it clear that payment stablecoins are not securities and that payment stablecoin issuers are not investment companies or investment advisers, thus exempting them from securities requirements. Finally, the use of payment stablecoins necessitates specific privacy and data security requirements, and users of payment stablecoins are provided with adequate privacy and data security protections. [11]

11. Statement:

Gary Gensler, Chair of the SEC, has declared that Bitcoin is a commodity, thus falling under the jurisdiction of the Commodity Futures Trading Commission (CFTC). He also noted that “all other digital assets apart from Bitcoin are securities,” which has major implications for the regulation of cryptocurrencies and digital assets in the United States. This would mean that the SEC will have a more assertive approach towards regulating the cryptocurrency market, with stepped-up enforcement against digital asset issuers that are thought to be securities, as well as exchanges that trade them. In addition, this would result in fresh regulations to bolster visibility and responsibility in the crypto sphere, with registration and disclosure requirements, as well as strict trading, reporting, and investor protection rules. Nevertheless, the SEC has made it clear that it will evaluate each token on a case-by-case basis to determine if it meets the criteria of a security. Therefore, it is not necessarily true that just because a digital asset is not Bitcoin, it is a security. In relation to the Stablecoin Transparency Act, SEC Chairman Gensler has highlighted the characteristics and advantages that make a stablecoin a security, such as the benefits provided by Binance and BUSD on its platform, including no fees when exchanging BUSD for certain other tokens, providing motivation for Binance users to keep their token. [12]

II. Application of the Current Legal Framework in the US Regarding Proof-of-Stake for Cardano

1. The Howey Rule considers whether Proof-of-Stake on Cardano is a security

Based on the analysis of the four criteria of the Howey Rule, it can be concluded that Proof-of-Stake on Cardano is not a security as users do not give up their assets, but rather just delegate their stake in the network. Holding ADA on the Cardano network means having a stake in the network, with the stake size being proportional to the amount of ADA held. Owners of ADA maintain full ownership of their ADA and are not investing money in return for a separable financial interest. Though the other three criteria of the Howey Rule may apply, the delegation process of staking ADA is not considered an investment contract and is not considered a security.

2. What are the Current Legal Requirements for Pool Operators on Cardano to be Compliant?

No change is necessary to ensure Cardano and its protocol are compliant with current legal requirements for pool operators.

3. What regulatory changes can be expected in the area of proof-of-stake based on the current draft legislation?

Given the current draft legislation, what regulatory changes can be expected in the area of Proof-of-Stake? Based on the Digital Asset Anti-Money Laundering Act Draft from 2022/12/15 and SEC´s penalty for Kraken from 2023/02/09, it is highly likely that lawmakers will introduce KYC/KYB/AML/CTF requirements to all blockchain transactions, including those involving Proof-of-Stake. The importance and market capitalization of Cardano means that these anticipated compliance changes will have an impact on its operations. With the recent regulatory developments, it is clear that cryptocurrencies are no longer exempt from a range of regulatory requirements.

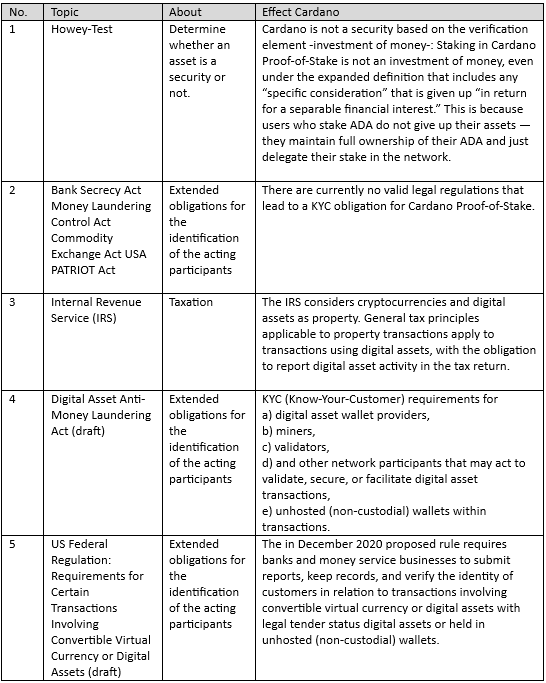

Table 1: Application of current legal compliance framework to Cardano proof-of-stake

III. How to ensure compliance with Cardano Proof-of-Stake based on requirements of the current U.S. legislative proposal Digital Asset Anti-Money Laundering Act?

Establishing a benchmark of excellence as a leader in the industry

Cardano Stake-Pool-Operators (SPOs) validate transactions on one of the top Proof-of-Stake cryptocurrency blockchains in terms of global market capitalization. SPOs anticipate the changes in the regulatory landscape and take it further by setting higher standards than what is currently enforced to add trust and compliance for our investors and delegators. Table 2 outlines the process for the creation and recyclability of KYC / KYB, including information on the legal validity per company.

Table 2: Reusable KYC / KYB: How it works in three steps

IV. About IAMX One-Stop-Compliance

Regulatory-compliant KYC, KYB, AML onboarding processes worldwide

Together with KYC SPIDER, IAMX provides a fully regulatory-compliant KYC, KYB, and AML onboarding process. Our KYC and KYB processes are legally sound and ensure regulatory compliance worldwide. The major USPs of our product are customizability, white label, interoperable API and data process integration, upgrades and updates per regulatory module, physical and digital access delegation of KYC files for reusability in the financial sector, 10 years storage, and access to Compliance front-end.

Global regulatory compliance made easier

This comprehensive solution is capable of providing regulatory compliance worldwide. With its scalable setup, high volumes from multiple regions could be processed centrally or decentrally. Any operating model for Compliance is fully supported.

Experience secure, and flexible KYC and KYB solutions with Our product, all reusable.

One of the major USPs of our product is its reusability, as well as the 10-year storage of KYC and KYB records. Furthermore, customers can also opt for physical or digital access delegation of KYC files, as well as upgrades and updates per module.

Comprehensive and secure KYC, KYB, and AML onboarding process offers essential regulatory compliance solution

Overall, IAMX AG’s fully regulatory-compliant KYC, KYB, AML onboarding process is an essential solution for businesses in need of a comprehensive, streamlined, and secure compliance process.

Customize your product experience with a wide range of fields for optimal results

Our product comes with a wide range of custom fields such as client type, client interest use CBAG services, asset flow client and CBAG, client experience crypto assets, investments in the last 12 months, trading volume currency p.a., and more.

Triangular agreement streamlines KYC/KYB processes

The triangular agreement ensures that our KYC and KYB processes are legally sound, and that a subscription model or pay-per-module structure is available for easy finance-related transactions.

Unlimited custom features: Tailor your product to your specific needs

We also offer unlimited custom features, allowing customers to tailor the product according to their specific needs. Our team of experienced professionals is always available to provide assistance regarding any queries.

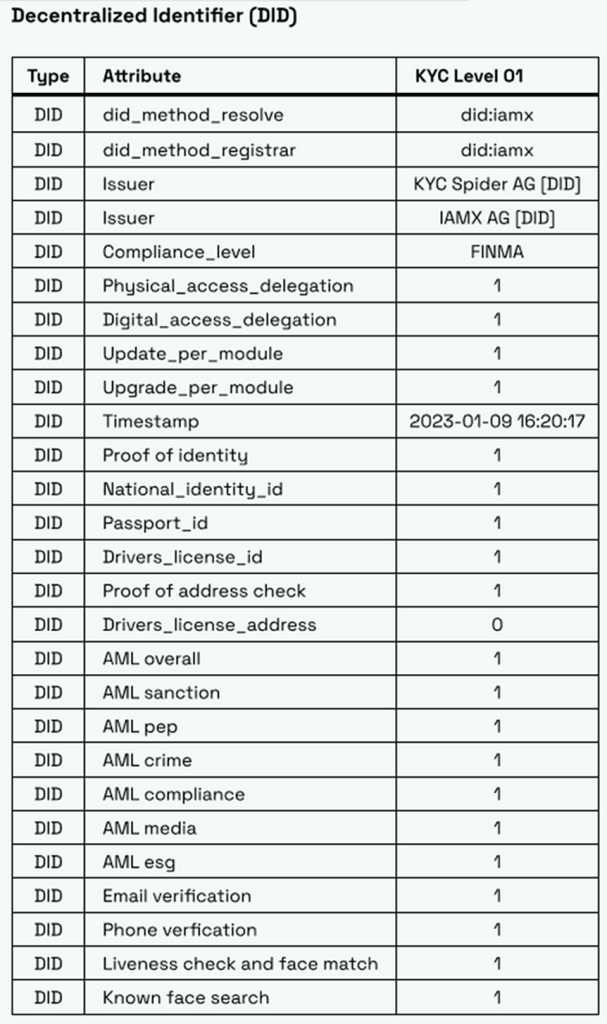

Table 3: Sample content for a DID that includes a FINMA-compliant KYC result

List of Sources

[1] Howey Test

https://en.wikipedia.org/wiki/SEC_v._W._J._Howey_Co.

[2] Internal Revenue Service

https://www.irs.gov/businesses/small-businesses-self-employed/digital-assets

[3] Commodity Exchange Act

https://en.wikipedia.org/wiki/Commodity_Exchange_Act

[5] Bank Secrecy Act

https://en.wikipedia.org/wiki/Bank_Secrecy_Act

[6] Money Laundering Control Act

https://en.wikipedia.org/wiki/Money_Laundering_Control_Act

[7] S.5267 — Digital Asset Anti-Money Laundering Act of 2022/12/15 (draft)

https://www.congress.gov/bill/117th-congress/senate-bill/5267

[8] Requirements for Certain Transactions Involving Convertible Virtual Currency or Digital Assets

https://www.govinfo.gov/app/details/FR-2020-12-23/2020-28437

[9] Infrastructure Investment and Jobs Act Reporting Requirements

https://en.wikipedia.org/wiki/Infrastructure_Investment_and_Jobs_Act

[10] USA PATRIOT Act

https://www.fincen.gov/resources/statutes-regulations/usa-patriot-act

https://www.fincen.gov/sites/default/files/shared/31_CFR_Part_103_312_EDD_Rule.pdf

[11] S.3970 — Stablecoin Transparency Act

https://www.congress.gov/bill/117th-congress/senate-bill/3970

https://www.banking.senate.gov/imo/media/doc/stablecoin_trust_act_section-by-section.pdf

[12] Statement, Article, NYMAG, Feb 23, 2023: Gary Gensler, Chair of the SEC, emphasized that Bitcoin is classified as a commodity

SEC on Kraken