Imagine a world where owning a slice of a luxury apartment in Paris, a masterpiece by Van Gogh, or even a vintage Ferrari is not a privilege reserved for the ultra-rich. This vision becomes a reality through the revolutionary concept of tokenized real-world assets (RWAs). Essentially, it involves transforming tangible assets like real estate, art, commodities, and even intellectual property into digital tokens stored on a blockchain, opening up a universe of investment opportunities previously inaccessible to most.

From Illiquid to Liquid Gold

The core value of tokenization lies in its ability to fractionalize assets, breaking down their ownership into smaller, more manageable units represented by tokens. This unlocks immense potential, transforming traditionally illiquid assets like real estate into readily tradable units on global platforms. Suddenly, investing in a piece of prime Manhattan real estate becomes feasible for the average investor, democratizing access to previously exclusive asset classes.

Boosting Liquidity, Transparency, and Efficiency

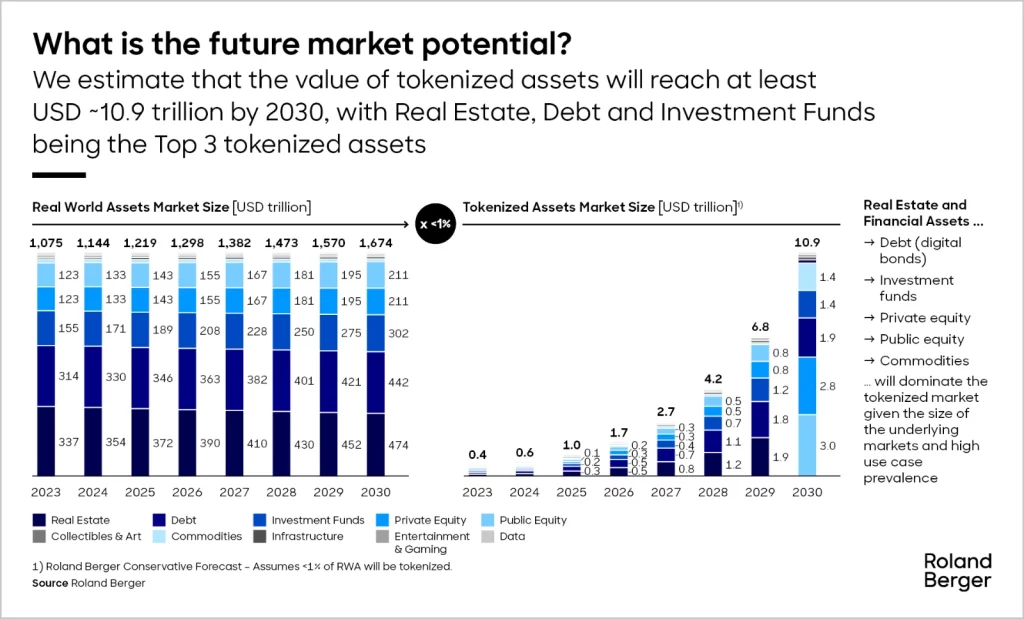

Beyond accessibility, tokenization offers a cascade of benefits. Unlike traditional markets with limited trading hours and cumbersome paperwork, blockchain-based token exchanges enable 24/7 global trading, granting investors greater flexibility and agility while the inherent transparency of blockchain technology fosters trust and reduces the risk of fraud. The immutability of the ledger provides an unparalleled record of ownership and transaction history, eliminating the need for intermediaries and streamlining processes, thereby minimizing administrative costs. According to Consulting Firm Roland Berger, the global potential of tokenized assets could reach at least USD 10.9 trillion by 2030, highlighting the immense economic force this innovation wields.

Illustration: The future market potential of tokenized assets

Source: Roland Berger

Unlocking Value Hidden in Plain Sight

The impact of tokenization extends beyond traditional investment avenues. Imagine tokenizing valuable intellectual property, like a renowned author’s future royalties, and offering them to fans, allowing them to share in the success of their favorite creations. This opens up new avenues for funding and empowers individuals to own a piece of something they value. Platforms like Royalties Network are already pioneering this exciting frontier, allowing musicians to directly connect with fans through tokenized ownership models.

Navigating the Murky Waters

As with any nascent technology, challenges accompany tokenization. Regulatory frameworks are still evolving, and navigating compliance intricacies demands careful consideration. Additionally, the inherent vulnerability of digital assets to cyberattacks necessitates robust security measures and reliable custody solutions.

Embracing the Future of Investments

Despite these hurdles, the potential of tokenized RWAs is undeniable. It represents a paradigm shift in asset ownership and investment, paving the way for a more inclusive and efficient financial landscape. While widespread adoption might take time, the seeds of disruption have been sown. As technology matures and regulatory frameworks adapt, we can expect a future where tokenized assets become commonplace, blurring the lines between the physical and digital worlds, and reshaping how we interact with and invest in real-world treasures.

The Tokenization Process: Demystifying the Magic

The journey from physical asset to tradable token involves a well-orchestrated dance of technology and legal expertise.

Asset Identification and Valuation: The first step is to identify and value the asset to be tokenized. From a quaint Parisian flat to a rare Picasso sketch, the possibilities are endless.

Legal and Regulatory Compliance: Navigating the legal landscape is crucial. This may involve setting up specialized entities like Special Purpose Vehicles (SPVs) to ensure compliance with applicable regulations.

Crafting Smart Contracts: These blockchain-based agreements dictate how tokens are created, managed, and traded, ensuring transparency and automaticity.

Ownership Record: The blockchain serves as an immutable ledger, permanently recording ownership and transaction history, offering unparalleled transparency and security.

Custody Solutions: Robust measures are essential to safeguard the underlying physical asset, whether it’s physical security for real estate or secure digital storage for virtual assets.

Exchange and Marketplace: Creating a platform where investors can buy, sell, and trade the tokenized assets is key to fostering liquidity and accessibility.

This intricate process paves the way for a more inclusive and dynamic investment landscape, one where the boundaries between traditional and digital assets begin to fade, and the dreams of owning a piece of the extraordinary become a reality for a wider audience.

In a Nutshell

Tokenized RWAs stand at the precipice of revolutionizing the world of finance. By unlocking accessibility, fostering liquidity, and enhancing transparency, they offer a glimpse into a future where asset ownership is democratized, and investment opportunities abound for all. While challenges remain, the potential is undeniable. As technology evolves and regulatory frameworks adapt, we stand on the threshold of a new era, where owning a piece of the world’s treasures transcends the limitations of wealth and geography, and the lines between physical and digital value irrevocably blur. The future of investment lies in the hands of tokenization, and its story is only just beginning.